Imagine driving off in your dream car without the hassle of complex financing options or monthly payments. Welcome to the world of no finance cars, where purchasing a vehicle becomes an exciting and stress-free experience — if done right.

In today’s fast-paced life, we understand how essential it is to find trustworthy and streamlined ways to own a car. This comprehensive guide is your go-to resource, offering clear and accessible insights on achieving car ownership without financial complications. Whether new to the concept of vehicle financing solutions or seeking expert advice, we’ve got you covered.

Dive in and discover how you can navigate the road to owning a car with confidence and ease.

How Do No Finance Cars Work?

No finance cars, often referred to as “cash cars” or “buy here, pay here” vehicles, are acquired without needing standard financing options. This route is typically favoured by people with poor or no credit history, as it eliminates the need to provide a credit report.

Instead, buyers can pay for the vehicle in full at the time of purchase, using their savings, borrowing from family members, or taking out a personal loan. This strategy allows them to gain complete ownership of the car right away, avoiding the burden of monthly payments and interest fees.

Bad Credit & Car Finance: What Options Do You Have?

For those who opt for the no car finance route, there are several options available to help you get behind the wheel of your dream car, regardless of your credit score. Here are a few financing alternatives that cater to individuals with less-than-perfect credit scores.

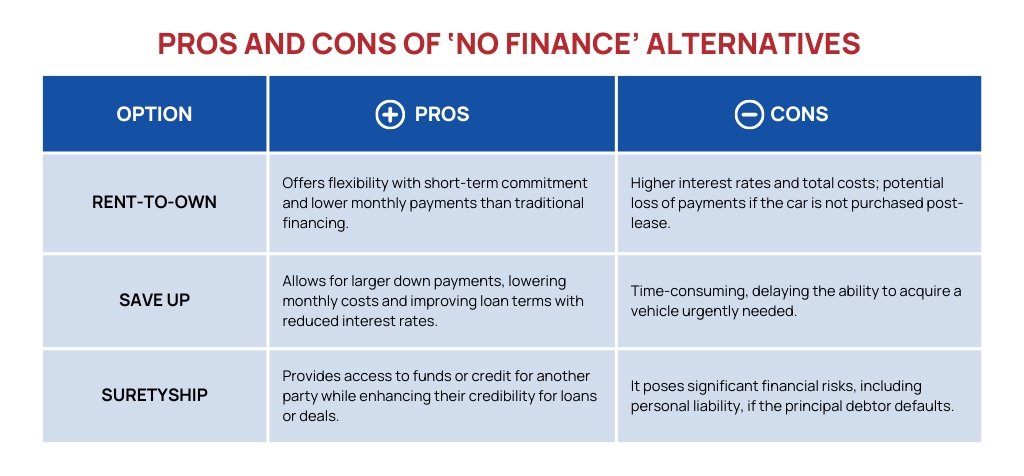

Rent-To-Own

In-house car finance dealerships often offer rent-to-own cars. These dealerships specialise in providing financing solutions without involving traditional banks.

Pros:

Rent-to-own car options offer flexibility and affordability. They let you lease without a long-term commitment, making it ideal for those uncertain about their financial future or who like changing cars periodically. Plus, they often come with lower monthly payments than traditional finance options.

Cons:

While rent-to-own cars seem appealing, they often come with higher interest rates leading to greater total costs. If you wait to buy the car post-lease, you could lose money already paid. So, evaluate your finances and future intentions thoroughly before choosing this option.

Save Up

If you have a low credit score, it can be challenging to secure a car loan with favourable terms. Saving up for a down payment can be a strategic way to improve your financial situation and increase your chances of getting approved for a loan with a lower interest rate.

Pros:

By Saving up you can make a larger down payment, lowering the amount borrowed, and thus having lower monthly payments. A larger down payment can also lead to a lower interest rate on the loan. This is because lenders view borrowers who can make a substantial down payment as less risky, thus offering more favourable terms.

Cons:

Saving for a car can be time-consuming, which may not be practical if you urgently need transportation. Delaying your car purchase to save for a down payment can prolong your ability to acquire a vehicle when you need it most.

Suretyship

Suretyship is a legal agreement where one entity promises to pay back a debt or fulfil an obligation if another person (the principal debtor) fails to do so. It’s a serious legal agreement that should be carefully considered before entering into it.

Pros:

By offering your guarantee, you enable a friend, family member, or business associate to access funds they need to pursue their goals or ventures, which they might have yet to be able to secure independently.

Additionally, it can also support a promising business deal or investment opportunity by enhancing the borrower’s credibility.

Cons:

Becoming a loan surety can pose significant financial risks. As a surety, you’re personally responsible for the debt if the main debtor defaults, potentially risking personal assets like your home. Suretyships might involve open-ended liability for future debts and it’s often tough to withdraw from these agreements later, even if misled about terms or debtor’s finances.

How to Find Reputable No Finance Car Dealerships

Finding a reputable dealership that offers car finance without a deposit is crucial to ensuring a smooth and reliable car leasing experience. Here are some tips to help you in your quest to find out how to finance a car with no credit.

- Research online: Search online for customer reviews and ratings to find dealerships that specialise in in-house car finance with no banks needed. Reviews from real people will help you get a clearer idea of their reputation.

- Seek recommendations: Ask friends, family, or colleagues who have had experience with no finance car dealerships for their recommendations. Personal referrals can provide valuable insights and help you find trustworthy dealerships.

- Check accreditation: Look for accredited dealerships with certifications that demonstrate their commitment to ethical and professional practices. This can give you peace of mind knowing that you are dealing with a reputable dealership.

- Visit the dealership: Once you have shortlisted where to get car finance with bad credit, visit them in person to get a sense of their professionalism and customer service. Take note of their inventory, the condition of their cars, and how they interact with customers.

- Read the fine print: Before entering any agreement, carefully read and understand the terms and conditions. Pay attention to any hidden fees or clauses that may impact your lease agreement.

Key Takeaway: Choose Wheelfin for Your No Finance Cars in Cape Town

Venturing into the world of no finance cars, particularly in Cape Town where inhouse car finance no banks is a viable option, can transform the car-buying experience into a thrilling and straightforward journey. Those who opt for in-house car finance with no ITC check can eliminate the stress of conventional financing.

This comprehensive guide explored various avenues, including rent-to-own schemes, saving strategies, and suretyship, which are tailored to help individuals with diverse credit backgrounds achieve car ownership.

By following these guidelines, you can confidently navigate the road to owning your dream car, making the process as enjoyable and efficient as possible. Dive into this exciting journey with the knowledge and assurance that you have the right resources at your disposal.