Owning a car in Cape Town isn’t just about convenience. For many, it’s the difference between being employable, running a business efficiently, or simply keeping family life on track. Yet, with rising living costs, strict bank requirements, and the high upfront price of vehicles, traditional car finance feels out of reach for thousands of South Africans.

That’s why cheap rent to own cars in Cape Town are getting so much attention. They promise the freedom of driving without hefty deposits or complex credit checks. But like any financial decision, it’s worth looking past the bold promises and asking: what’s the catch?

The Appeal of Rent-to-Own Cars

Rent-to-own auto loans are so popular because they make sense: you choose an automobile, pay a fixed fee every month, and after the term, 48 to 60 months, you own it. It’s not a lease, where you turn back in the keys. This vehicle gives you a direct path to ownership without the hefty down payment of regular auto loans.

For individuals with bad credit records, blacklisting issues, or undesirable income, rent-to-own cars generally represent the only method of driving legally and safely on the busy roads of Cape Town.

Affordability and Transparency

At first glance, rent-to-own deals look like affordable car deals, no deposit, predictable monthly payments, and flexible terms. For some, that is simpler than laying the cash down to purchase second-hand cars in Cape Town or borrowing no deposit car finance from a bank.

But affordability isn’t just about the monthly payment. You’ll need to ask the right questions about insurance, maintenance, and penalties to avoid being caught off guard.

What’s the Catch?

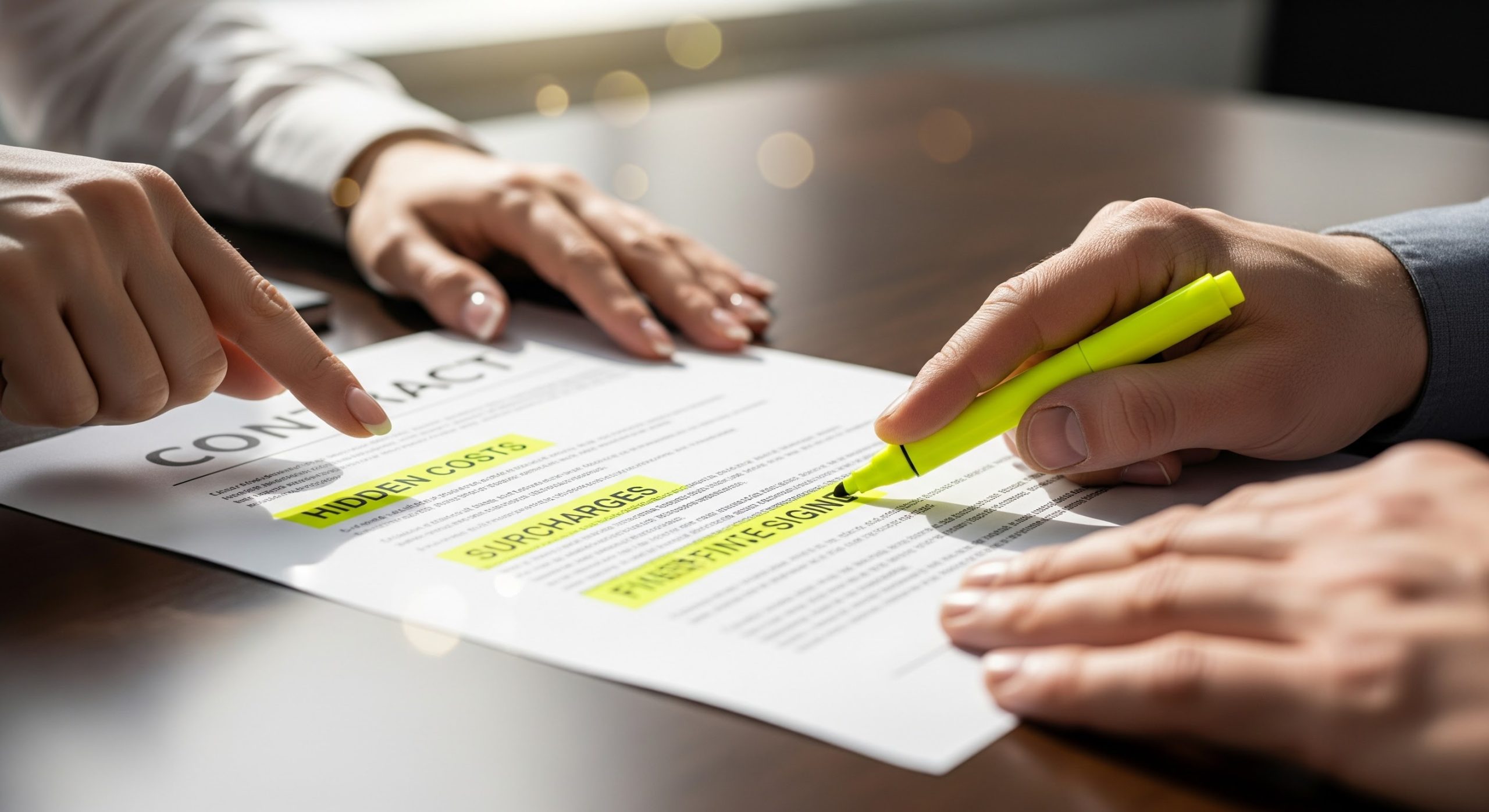

Here are some of the areas to explore before you sign:

How much will it cost you?

Low monthly payments can add up over 4–5 years. Compare the total repayment against the market value of the car.

Insurance included or extra?

Some rent-to-own companies bundle insurance and licensing into the deal, while others leave it to you. Make sure you know who covers what.

Who is responsible for maintenance?

Basic servicing may be included, but check if you’ll be liable for wear-and-tear items like tyres and brakes.

Penalties for late payments.

Missing a payment could mean repossession. Understand the grace periods and fees before committing.

Early settlement options.

If your financial situation improves, ask whether you can pay off the balance early and save on interest or fees.

Rent-to-Own vs. Other Financing Options

- Traditional car loans: Lower interest if you qualify, but require deposits and good credit.

- Leasing: Lower monthly costs, but no path to ownership.

- Rent-to-own: Easier access, higher long-term costs, but ends with ownership.

For many drivers, the choice comes down to whether they value access and flexibility today over potentially paying more overall.

Qualifying for Rent-to-Own Financing

One of the biggest advantages is that qualifying is easier. Many providers welcome self-employed individuals, those under debt review, or people with little to no credit history. Instead of credit scores, they’ll focus on your monthly income and ability to keep up with payments. This makes rent-to-own attractive for anyone locked out of traditional finance.

Is Rent-to-Own the Right Option for You?

If you need a car quickly, don’t have a deposit saved, or have been rejected by banks, cheap rent to own cars in Cape Town can be a lifeline. However, it’s not always the cheapest route in the long run.

Think about your lifestyle:

- Do you need predictable monthly costs more than rock-bottom total costs?

- Are you prepared for the responsibility of ownership at the end of the contract?

- Would a short-term lease or even a cash deal on a small used car be more cost-effective?

Making an Informed Decision

Rent-to-own cars aren’t a scam , they’re simply another financing tool. Like any financial product, they come with pros and cons. By asking the right questions about insurance, maintenance, and total repayment, you can avoid the pitfalls and drive away with peace of mind.

At Wheelfin, our unique rent-to-buy programme in Cape Town includes insurance, licensing, and service plans in one monthly payment, making the process transparent and helping you avoid hidden surprises. That’s how we’ve built trust with customers who were once told they’d never qualify for car finance.

Driving Forward With Confidence

At the end of the day, rent-to-own is about more than just signing a contract, it’s about regaining independence and stability. For Cape Town residents who have struggled with bank finance, cheap rent to own cars offer a practical way forward. The key is to partner with a provider that values transparency, bundles in the essentials, and won’t surprise you with hidden costs.

At Wheelfin, our unique rent-to-buy programme in Cape Town is built on that promise. With insurance, licensing, and service plans included in one monthly payment, we make sure what you see is what you pay. No hidden catches, no balloon surprises, just a clear road to ownership.

🚗 Ready to explore your options? Apply today and discover how easy it can be to drive home in a car you can truly call your own.