Securing a car loan in South Africa can be daunting, especially when credit scores are involved. A poor credit score can lead to higher interest rates and stricter loan terms, making your dream car seem out of reach.

Understanding the minimum required credit score to finance a car is crucial. This blog will highlight the significance of credit scores in auto financing, their impact on loan terms, and essential information you need to secure a car loan in South Africa.

Let’s explore the path to buying your new vehicle with confidence.

Understanding Credit Scores

Understanding how credit scores are calculated and interpreted can empower you to make informed decisions about your financial options and improve your chances of securing favourable loan terms.

Components of a Credit Score

A credit score is a numerical representation of your creditworthiness, reflecting how likely you are to repay debt based on your financial history. In South Africa, credit scores typically range from 0 to 999, with higher scores indicating lower risk to lenders.

Lenders use this score to evaluate the risk of granting credit, influencing loan approval, interest rates, and terms. You can check your credit score through licensed bureaus like TransUnion or Experian, with one free report available annually.

Regularly monitoring your score helps you stay informed and address any inaccuracies that may affect your financial opportunities

Factors Beyond Credit Scores

Beyond credit scores, lenders consider several additional factors when evaluating car finance applications. Whether permanent or self-employed, your monthly income and employment status play significant roles. The debt-to-income ratio and overall financial stability are also crucial, indicating your ability to manage new debt.

Lenders also examine your payment history, credit utilisation, and length of credit history to assess reliability. The types of credit you have and recent inquiries into your credit report can also influence the decision.

Typical Credit Score Ranges

| Type | Score |

| Excellent | 750+ |

| Good | 700-749 |

| Fair | 650-699 |

| Poor | 600-649 |

| Bad | Below 600 |

What Is a Good Credit Score for Car Financing?

To navigate the complex world of car financing in South Africa, it’s essential to grasp the fundamentals of credit scores.

Minimum Credit Score for Car Financing in South Africa

In South Africa, the minimum credit score required to finance a car is typically around 600, though this can vary depending on the lender. A score near this threshold may qualify you for financing, but lenders often view it as a higher risk. Borrowers with lower scores will likely face higher interest rates and may need to provide a larger down payment to secure the loan.

What’s a Good Credit Score to Qualify For a Car?

A credit score above 670 is considered “good” and offers significant advantages. A higher score makes you more likely to experience a more straightforward approval process, access better loan terms, and benefit from lower interest rates. Maintaining or improving your credit score is essential for securing favourable car financing deals.

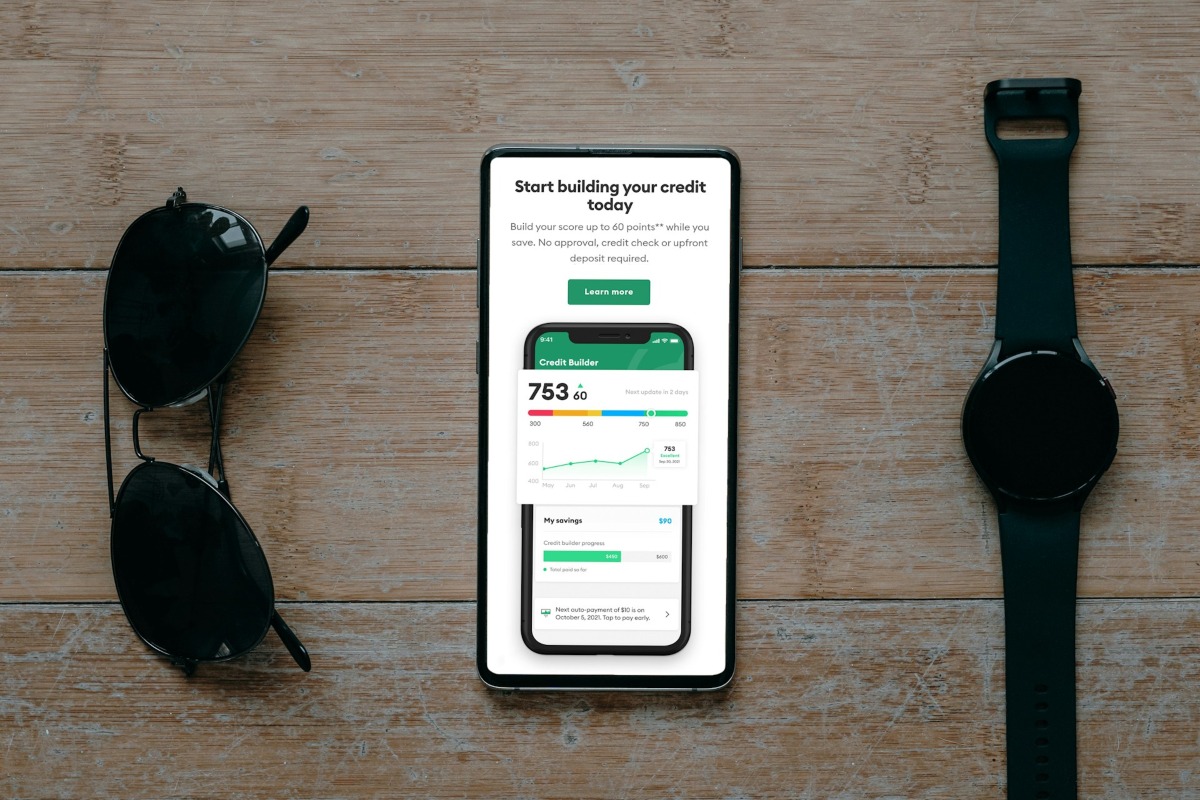

Steps to Improve Your Credit Score Needed to Finance a Car

Improving your credit score is a strategic move that can significantly enhance your chances of securing favourable car financing terms in South Africa. Implementing a few simple yet effective strategies can boost your credit score over time, paving the way for easier loan approvals and better interest rates.

Paying Bills on Time

Consistently paying your bills on time is one of the most effective ways to improve your credit score. Late or missed payments negatively impact your score, so setting up reminders or automatic payments can ensure you stay on track.

Reducing Debt-to-Credit Ratio

Your debt-to-credit ratio, or credit utilization, measures how much of your available credit you’re using. Aim to keep this ratio below 30% by paying down existing debts and avoiding maxing out your credit cards.

Regularly Checking Your Credit Report for Errors

Errors in your credit report, such as incorrect payment records or outdated information, can harm your score. To maintain an accurate credit history, regularly review your report through bureaus like TransUnion or Experian and dispute any inaccuracies.

Financing Options for Cars for Blacklisted and Low Credit Score Individuals

Securing car financing with a low credit score in South Africa is possible, but it often requires exploring alternative options.

Alternative Financing Options

Using an alternative financing option like Wheelfin can be a very good place to start. We believe that everyone deserves the chance to own a car regardless of their credit history. Whether you’re blacklisted or have a low credit score, we specialise in hassle-free vehicle financing solutions tailored to your needs.

Our expert team helps you secure the best rent-to-own and car pawning deals, helping you get behind the wheel without the usual roadblocks. With flexible terms and a fast approval process, we make car ownership accessible, even when traditional banks say no.

Subprime Loans

People with credit scores below 600 may qualify for subprime loans, which are tailored for high-risk borrowers. These loans allow access to financing despite poor credit but typically come with higher interest rates and stricter terms. While they provide an opportunity to own a car, the costs can be significantly higher than traditional loans.

Legal Protections

The Consumer Protection Act and the National Credit Act are essential frameworks designed to protect all consumers, including those who may be blacklisted. These laws ensure that such individuals receive fair treatment from lending institutions, while also providing important mechanisms for resolving disputes and addressing grievances effectively and equitably.

How Much Credit Score is Required for a Car Loan

Navigating car financing with a low credit score in South Africa can be challenging, but understanding the landscape and taking proactive steps can significantly improve your chances of success. By following strategies like paying bills on time, managing debt responsibly, and correcting any errors on your credit report, you can gradually improve your creditworthiness.

Remember, a healthier credit score not only increases approval chances but also saves money in the long run through favourable terms and lower interest rates. While a minimum credit score of 600 may be sufficient to secure a loan, aiming for a higher score will unlock better financing opportunities, making owning or buying a car more affordable and accessible in the long run.